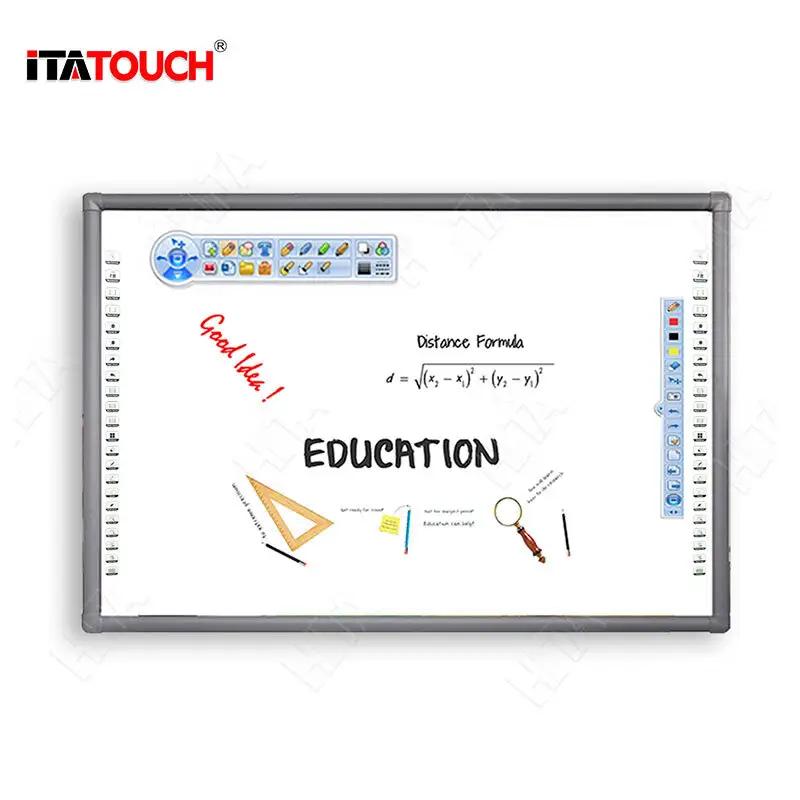

ITA TOUCH is a leading interactive flat panel and smart board manufacturer in China

kodak blows itself up in hopes of surviving - document camera for sale

ROCHESTER, N. Y. —

All the photos you took years ago in a movie, stuck in a scrapbook or shoe box will theoretically last for centuries.

As part of popular culture, the word Kodak moment may continue to exist in the coming years.

But Kodak itself?

Story: Kodak sells digital imaging patents Kodak has struggled to enter the digital ageSurvival of the company that invented film photography and mobile phone photography technology for the public, because it transformed itself into a part of the business printing and packaging industry.

Kodak is likely to go bankrupt through its ongoing 11 chapters almost every day.

11 months later, Kodak received $0. 83 billion in credit from various lenders --

The money should take it to the other side for the rest of the bankruptcy.

The company continues to insist that it will withdraw from bankruptcy sometime in the first half of next year

But ultimately profitable companies. That post-

Kodak's bankruptcy will have little resemblance to the company that filed for bankruptcy protection in January.

Although the company will continue to produce ink, the manufacture of desktop inkjet printers will stop next year.

Kodak expects to save $100 million next year to end all its long-standing health benefits for retirees.

According to the company's estimates, the company has cut about 3,700 jobs worldwide this year, with about 1 out of every 5 workers, including many middle and senior managers and hours.

But perhaps most importantly, Kodak will quit the photography industry.

The digital camera business has been shut down.

Photographic works-Paper and quiet

The camera film business will be sold with this document

Scanners and photos

Self-Service Business.

The heavy burden is not coming out of bankruptcy, but after months and years.

Art Roberts, president of Kodak retiree group EKRA Ltd, said: "The main problem is longevity . "

"There may be enough confidence in 12-to 24-

But is there any technology that can bring it to the future? I don't know.

"If Kodak has a fan, it's John Price.

Mercury Print Productions's chief executive here installed the Kodak Prosper 5000 digital press last year.

He expects to install the Prosper 1000 in a few weeks and hopes to buy the Prosper 5000 again sometime next year.

"They have the best technology," Place said . "

But Kodak has been performing poorly in marketing.

"Since Mercury installed the Prosper 5000, many potential Kodak customers have gone through Mercury and have seen that digital presses are running almost all the time, producing textbooks in large quantities.

"My opinion is ,(Kodak)

"It will be successful," Place said . ".

"We will help them succeed.

After decades of maidas-

Like the wealth of light

Sensitive chemicals on plastic strips, Kodak sees the next life around a similar deposition process --

This is printing.

Specifically, Kodak is seeking services in the commercial printing, packaging printing and printing industries --

And just-

Emerging areas of functional printing

Become it's next life.

Choice is not accidental.

This process of thinking began in the medium term.

Christopher Payne, Kodak vice president of business, said 2000to-

When Kodak began to buy a variety of prints, commercial marketing

Related business, spend hundreds of millions of dollars on companies such as NexPress and Scitex.

Kodak entered the packaging field more recently and launched the Flexcel NX printing system in 2008.

Function Printing-

Using printing technology as a means of manufacturing products such as circuit boards or solar cells

It is in its infancy.

Today, printing "is the only business they can get out of bankruptcy and hopefully succeed," Webster Kelly said. Y.

After 34 years in the company, he retired in 2007 and spent most of his time on the company's strategy. The high-

The high-speed inkjet Prosper system is a breakthrough technology, Kelly said.

"If they succeed, it will be a real opportunity.

"Packaging printer Hammer Packaging in N HenriettaY.

Has always been a user of Kodak pre

News products like plates before and during bankruptcy.

"Everything is on time," said CEO James hammer . ".

"They have good products.

Credibility still exists.

"But whether Kodak can make a splash in packaging and printing will depend on whether it can provide technology and products that distinguish it from its competitors --

Similar to inkjet technology in commercial printing, Hammer said. Kodak owns February.

The deadline for its plan to repay creditors and withdraw from bankruptcy.

The plan must be approved by the US government. S.

Bankruptcy Court

Even if Kodak's creditors signed the plan, "it doesn't necessarily mean that the parties are confident that the company will succeed," said John C. , "there are just some possibilities, it was the best deal they could get at the time, better than an orderly liquidation. "

Ninfo II, a retired AmericanS.

Bankruptcy judge in West New York.

However, it is now arguably not the best time to put the farm on print.

According to economic statistics from the quarterly census bureau, while it is a growing industry in many developing worlds, commercial printing in the United States is declining.

Xerox is another traditionally dominant company in western New York.

As the growth of its printing equipment business slowed, it made a lot of bets on commercial services.

According to Kodak, the difference is its printing technology, its high

High-speed inkjet technology has put it on the holy grail of the printing world --

The speed and image quality of offset printing, but the ability to carry out short-term printing or the personalized nature that comes with numbers.

However, Kodak has a huge history of technology, and it can never be transformed into great wealth.

Organic light-LEDs.

Digital photography.

As the end of gold halogen silver photography becomes apparent, Kodak has a history of throwing a lot of spaghetti on the wall to see what might be going on from digital photography to Pharma.

"Kodak's biggest problem is its success," says Roberts of the retirement organization . ".

"The profits in the film industry are so high that all other technologies have been second cousins in the past few years.

"If Kodak was able to convert its digital imaging patent into cash sooner or more luckily, its bankruptcy could become very different.

Part of the reason for the company's bankruptcy is the United States. S.

Such a sale would bring protection to the bankruptcy court.

And Kodak-

The potential value of hiring consultants is $2.

4 billion, patents, Kodak announced last week that it had signed a preliminary agreement to make them $0. 525 billion.

And the company's goal in bankruptcy reorganization-

Such as selling patents, cutting the cost of benefits for retirees

Kodak spokesman Christopher Veronda said that we have remained the same for the past 11 months, "we must make some difficult decisions throughout the restructuring process based on the realities that need to arise.

Kodak management "made a lot of wise decisions to enter Chapter 11 --

As far as the pension plan is concerned, they have too much baggage and too much weight.

A Rockland County in New York state. Y.

Intellectual Property Services.

"They had to get rid of it.

Poltorak said: "Although the patent sale may also be the right decision, the patent may have been sold a long time ago.

This is a big mistake.

"There are many supporters of 'unkodak' emergesKodak who count on it for a viable future.

Several financial institutions and hedge funds are financing the company for $0. 83 billion.

"If you drop the $0. 83 billion, you have to have some reasonable assurance that you will get your money back," Roberts said . ".

Ken Luskin, of Intrinsic Value Asset Management, said that while bankruptcy usually wiped out shareholders' shares and left worthless paper with the issuance of new shares, Kodak shareholders may see some returns

"What will you get at this point (

Photo Booth and document scanner business)?

How much can you knock (the U. K.

Pension obligations)?

"If they can get a decent valuation, shareholders have the remaining equity," he said . ".

At the same time, there is a lot of pessimism in the investment community.

What is the average price of Kodak shares this year?

About 27 cents.

Credit-rating companies like Moody's, S & P and Fitch don't even bother to score Kodak's corporate debt today.

Another argument is that Kodak has no value.

Terrence Faulkner, vice president of retirement, in a letter to the United StatesS.

Earlier this year, the bankruptcy court held that Kodak could go bankrupt soon after bankruptcy, taking into account the challenge of slide competition for desktop inkjet and other product lines such as photographic paper and film.

Today, he said: "Kodak is no longer Kodak, it has withdrawn from film, digital camera, inkjet technology and stripped health.

"These initiatives, coupled with the sale of the digital imaging patent portfolio, will make" a very different and much smaller company, "Faulkner said ".

At the same time, Kodak's remaining business will face competitors who are "bigger and more funded than the emerging UnKodak.

"While businesses are hesitant to invest in new equipment, UnKodak is trying to get rid of Chapter 11," said Faulkner.

The retiree group EKRA estimates that unsecured creditors will receive a return of 10 cents to 20 cents in dollars, making it extremely unlikely that shareholders will see their stock survive.

"The strategy for moving forward still makes sense," said Jim Weaver of N. Irondequoit. Y.

Earlier this year, he retired from Kodak after spending most of his career in R & D and commercialism.

"But it's not a dunk. . . .

The way forward, we are no longer doing a cash cow business.

These will undoubtedly be challenging businesses.

Matthew Daman is also (Rochester, N. Y. )

Democrats and Chronicle

Click here to zoom in. (

The image will open in a separate window. )

info@itatouch.com |

info@itatouch.com |  + 86 13582949978

+ 86 13582949978